Online Banking Safety Measures

Online banking has become a part of almost everyone’s life and has made life so much easier and less stressful. As with everything there are sometimes problems and when it comes to online banking it may come in the form of hackers and fraudsters. This being said there are some tips that people can use to improve their online banking safety.

Wi-Fi Networks

Public Wi-Fi is great and easy to access, but not ideal for online banking or Australian sports betting. These networks are sometimes not encrypted, which makes it easier for hackers to access people who are maybe not as vigilant as they should be. It is best to not make use of public Wi-Fi networks and to rather access online banking from home or where it is safe to do so. Another option may be to use mobile data or a personal hotspot from a smartphone.

What to Look For

There are unfortunately many websites created to do phishing. When logging onto a particular website or clicking on a link there should be a padlock icon in the web address bar and it should always have https at the start of the address. There is also the option to download a https browser extension which will encrypt web data.

Banks will always tell their clients that they will never email or text and ask for login details. If this does happen it is best to let the bank know and inform the bank of the message received. People should also not be taken in by emails offering money in exchange for banking information. These are scams and it is important to let the bank know immediately.

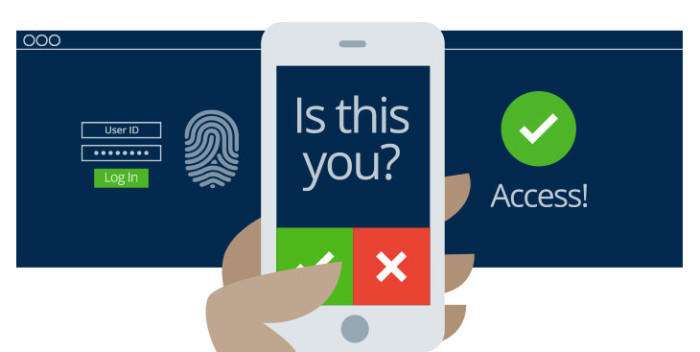

Two-Factor Authentication

Most banks will offer their clients extra security and this is called two-factor authentication. With this extra security clients will be required to enter a verification code before accessing their account. If someone else tries to log in the client will receive a text or email and will be asked to enter a code and username and password. This security measure is usually free.

Passwords

Many people will store their username and password information in their web browser. There are also browsers that will automatically save this information, so it is always important to check that this feature has been disabled.

Having a strong password is the first step to online banking safety. These passwords should have both uppercase and lowercase, numbers and symbols. The password should be changed on a regular basis and it is important to have different passwords for different sites or apps. There are password managers available which are great for remembering password information. Never use consecutive numbers or dates of birth for example.

Anti-Virus Software

Everyone should have anti-malware as there are many computers not are protected. Antivirus software is excellent to keep hackers away from computers. A really good antivirus will check emails, scan browsers, prevent viruses and pop-ups. The anti-malware should be updated regularly to ensure that a computer is properly protected all the time.