All Bout eWallets

The Internet has improved our lives in more ways than we sometimes realise. Not only does it give us access to all of humankind’s accumulated information, but allows us to listen to music, talk to people from across the world, stream films and television series, and even make use of banking.

For a long time, online banking was done strictly through various official, land-based banks, meaning that we didn’t have many options in terms of online transactions. Then came the invention of the eWallet, an online savings pocket and transactional tool that allows users to move money around online safely and anonymously. The modern eWallet is simple and easy to use, and has seen great success in a number of industries, especially in the casino world where people are able to wager on AFL premiership betting without worrying about giving our personal and financial details.

How do eWallets work?

For the most part, modern eWallets come in the form of a secure online account that only the owner has access to through it a username and password. This means that no one else has access to the eWallet, as long as the password used is strong, and isn’t given out to anyone else. Once the account is created, the eWallet can store, money both online and even offline, and allows transactions to be completed through any system that accepts eWallets as a banking method. They’re considered one of the fastest methods of moving funds around online, as they often have minimal waiting time when it comes to withdrawal and deposits.

The Types of Wallets

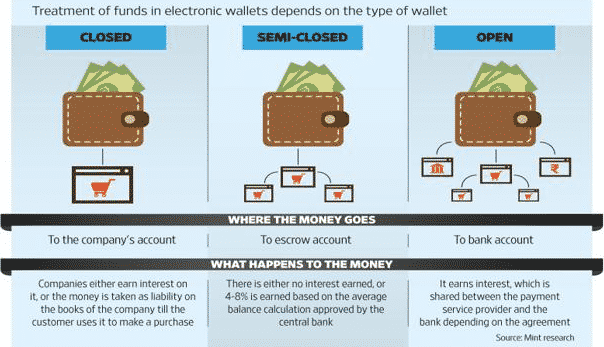

There are three main types of eWallet that can be found most commonly online: closed, semi-closed, and open.

Open eWallets are ones that are free for withdrawal and deposit, and are linked to the user’s main bank account. The money placed in an open wallet earns interest, which is then shared between the bank linked to the account, and the payment service provider, depending on the agreement between the two parties.

Closed eWallets work differently in that money that is sent to the account can only be used by the company that issues it. This means that while the eWallet in question cannot be used to purchase at random online, they can be used at that specific company. The company that issues the wallet earns interest on the amount of money in the wallet, or the money in the account is taken as liability on the books of the company, until a purchase is made by the customer.

Semi-closed eWallets are a mixture of open and closed, and require an RBI approval before the user can start using them. They can be used to purchase products and services online, payments of fees, financial services, and much more, but require that the company/individual that you’re buying from as a contract with that specific eWallet. Money sent into this kind of wallet is automatically added into an escrow account, and often there is no interest earned.